The digital economy has recently undergone a remarkable cycle of innovation in new forms of digital value, including money itself. From cryptocurrency and non-fungible tokens (NFTs) to central bank digital currencies (CBDCs) and blockchain-based digital assets like stablecoins —the world of finance is undergoing a transformation of unprecedented magnitude, comparable to only a handful of pivotal moments in history.

But what exactly is a digital asset?

The market structure of the digital asset ecosystem, which was initially centered around retail, high-net-worth, and crypto-native investors, has undergone significant expansion.

This expansion is evidenced by the inclusion of traditional institutional investors who have integrated digital assets into their existing portfolios of traditional investments.

Additionally, monetary authorities have played a crucial role in this evolution by either adopting digital currencies as legal tender, as seen in the case of El Salvador, or by introducing digital versions of their respective national currencies, as exemplified by China’s digital Yuan.

Imagine a digital asset as a valuable item in a virtual box. This box can contain anything that is stored digitally: a piece of digital artwork, a video, a contract document, or even digital money. These are electronic files that you can own and move around, much like you would with a physical object in the real world.

How do we keep track of who owns these digital boxes and what is in them? This is where a system similar to a public library’s catalog comes in – the blockchain. This record is not stored in one place but is spread out across many computers worldwide (decentralized).

What is a Cryptocurrency?

Cryptocurrency refers to a digital or virtual form of currency that utilizes cryptography to safeguard transactions.

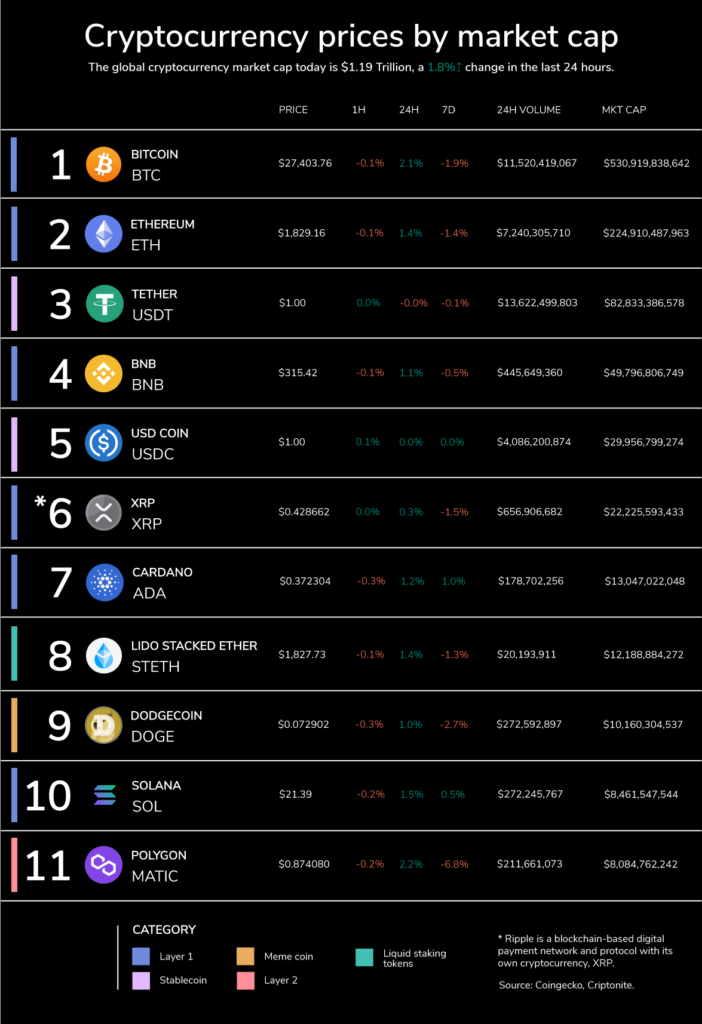

The two most prominent blockchains within the cryptocurrency realm are Bitcoin and Ethereum. Bitcoin holds nearly 40% of the total value in the cryptocurrency market, making its blockchain widely recognized. On the other hand, the Ethereum blockchain stands out for its extensive number of transactions.

What is an NFT ?

An NFT is a digital asset that can come in the form of art, music, in-game items, videos, and more. It is also generally one of a kind, or at least one of a very limited edition, and have unique identifying codes. Each NFT has a digital signature that makes it impossible for NFTs to be exchanged for or equal to one another.

If you are keen to start your own NFT collection, you will need to acquire some key items: a digital wallet that allows you to store NFTs and you will need to purchase some cryptocurrency, most likely ETH as most NFTs are part of the Ethereum blockchain. You can buy crypto using a credit card or crypto exchange.

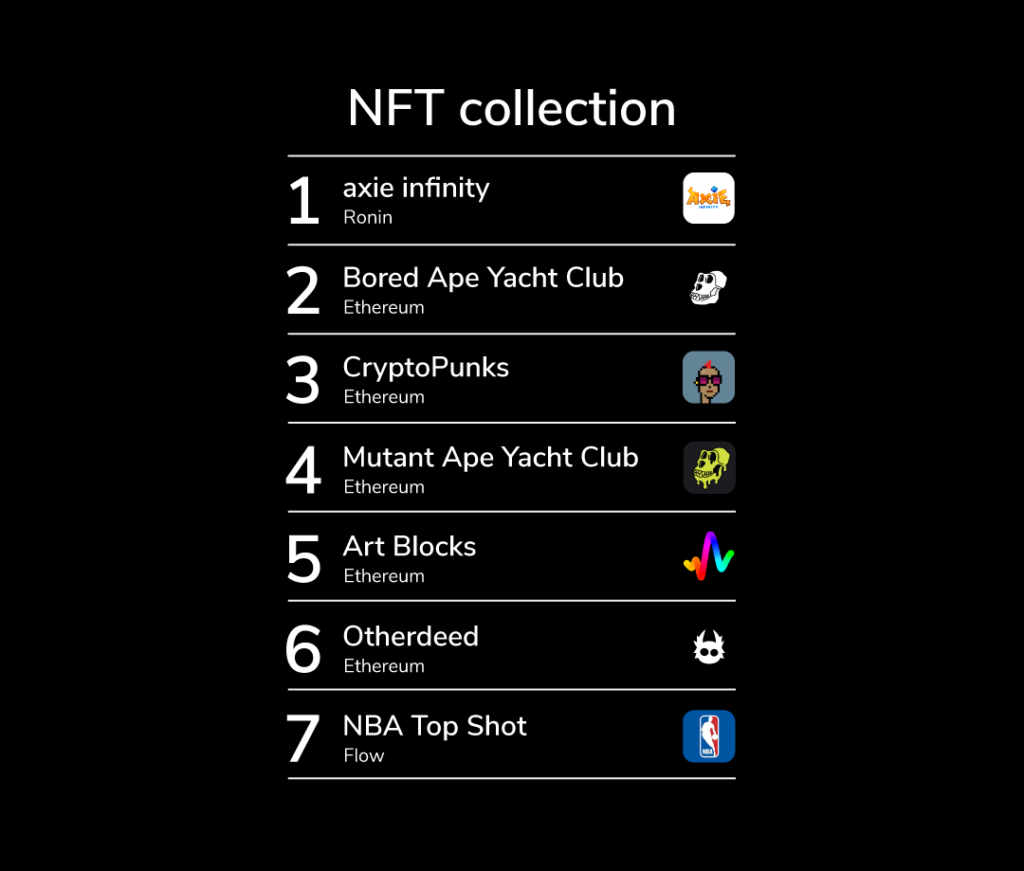

You can find below the NFT Collection ranking by sales volume since their launch: Axie Infinity, an NFT-based play-to-earn online game is still ranked no 1. No 2 is the collection of digital art named Bored Ape Yacht Club with one of the strongest community of the NFT space. No 3 CryptoPunks, considered as one of the first and most notable generative PFP (Picture for Proof) collections, was launched as a fixed set of 10,000 items in mid-2017 by Larva Labs. They have been featured in prestigious publications (NYT, Christie’s of London and Art Basel Miami).

What is CBDC?

A central bank digital currency or CBDC is a virtual currency backed and issued by a central bank.

CBDCs have the potential to enhance the efficiency and security of payments among banks, institutions, and individuals. However, in contrast to cryptocurrencies that utilize permissionless (public) blockchains, CBDCs are built on permissioned (private) blockchains.

A private blockchain is a distributed ledger that functions as a closed, secure database based on cryptography concepts and is not decentralized. Thus, restrictions on the CBDC networks are set by a central bank.

If you want to learn more about digital assets feel free to visit the Criptonite Academy “The Basics of Digital Assets”.

Digital assets and blockchain technology are not only provoking unprecedented changes in the big picture of digital economy, but also in the e-commerce environment. Interested? How blockchain technology is leaving e-commerce to the dust.