Looking at the state of the worldwide economy you might have been wondering if right now is the right time to invest. With inflation, the war between Ukraine and Russia, and the fallout of the COVID crisis, markets have been trending downwards. However, history tells us that usually, markets tend to recover.

Highs and lows

It’s important to understand that markets are cyclical in most cases. They go up and down, over and over again. Just because the market is down doesn’t mean you should panic – it will recover, as it usually does.

Markets are cyclical

Throughout the 20th century, and even now, we saw a lot of market crashes. Some were worse than others, but the markets have often recovered. The 1929 and 1970 Great Depressions, the Asian financial crisis, the internet bubble, 2008, and the European sovereign debt crash were all periods where the markets crashed to extreme lows. But over time they recovered, in most of the countries. There are many examples from the past that should reassure us, but market recovery takes time.

When indexes go high, they tend to take the stairs, meaning, they earn a little percentage in a day. But in the long run, it tends to form an upward trajectory. However, when they crash, they take the elevator, losing, for example, 4% in one day. This tends to give the perception of a significant drawdown and causes panic.

Let’s take a deeper look into the difference between how fast bullish and bearish markets are moving daily.

Recovery doesn’t happen overnight

Since 2009, we could see a bullish trend, a trend where markets grow or are expected to grow. Since then, International Indexes grew on average 16% a year in 11 years.

However, for the past 2 years, we have faced two difficult scenarios: one in 2020 when the COVID pandemic hit the world, and one we are currently living in it, sanctioning entry into what’s called a bear market. A bear market is when stock prices are on a long-term downward trajectory and prices fall 20% or more.

But what can you do to protect your investments when markets are not in your favor?

Many confirmations, few exceptions…

Looking at the worldwide indexes, we can see this trend in most of them. For example, we show you the US500 for the period 1992 – 2022. I highlighted the main crisis on the chart and the follow-up in the next periods.

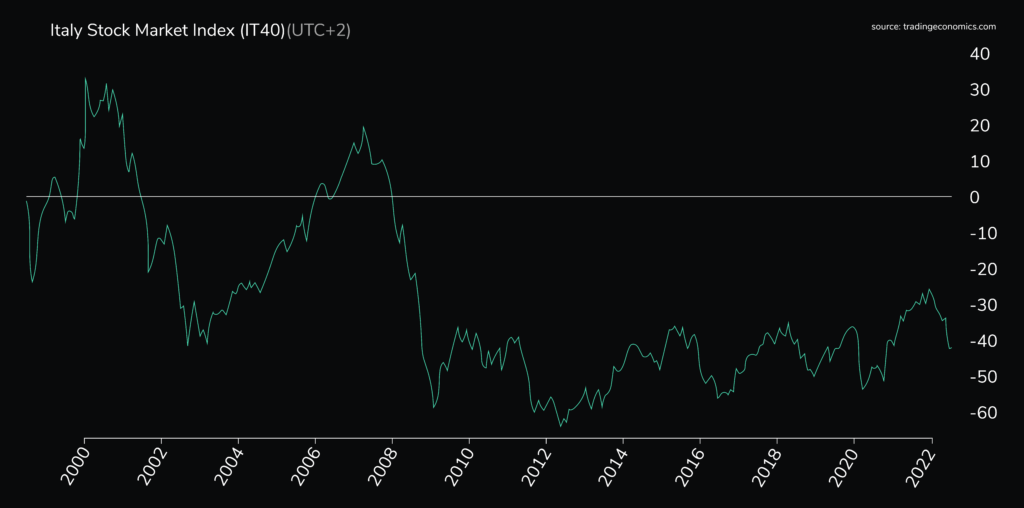

I said markets USUALLY recover their drawdown. There are of course exceptions. Still today, the Italian Index did not recover entirely during the last 20 years.

To conclude, when we take indexes together, globally, they are following the trend. But it is not always guaranteed that all indexes will be catching up. That’s why it is important to take a few precautions to try to protect your portfolio during difficult years.

Maintain your course

Here are some steps you can take to protect yourself in these turbulent situations:

- Maintain a long-term perspective: Having a long-term investment strategy can protect your investment and make sure that your portfolio survives every bump in the market.

- Diversify your portfolio: Having a diversified portfolio can help you survive a sector-wide market crash. For example, an investor who had invested only in the dot-com bubble would have lost everything when the bubble burst. If they had invested in more than one sector, parts of their investment would have survived that crash.

- Understand the importance of compound interest and value investing

- Listen to your financial advisor

- Make sure your emotions don’t impact your investments

But more importantly, remember that historically, most of the market cycle will end eventually (the last one was in 2011).

A market crash can be scary, but it’s not the end of the world.

It can be scary to see your investments drop in value. But it’s important to remember that a market crash is a natural part of the market cycle. It happens regularly, and you could see it as an opportunity to buy more shares at lower prices.

History tells us that market will recover at some point—as so long as you have a long-term plan for investing. And most importantly, don’t panic during a drawdown. This is likely when other investors will want their money back!

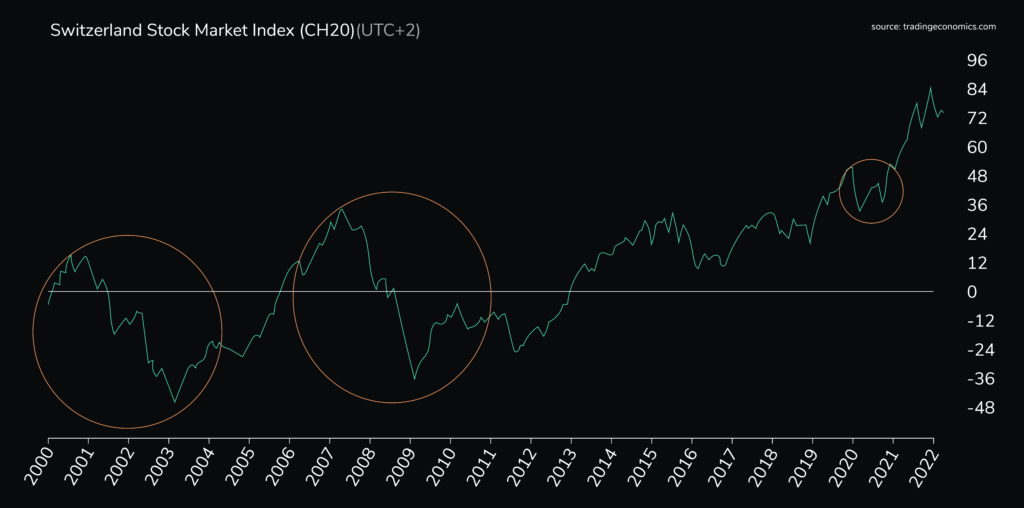

By the way, how did the Swiss stock exchange behave in these scenarios?

Highlighting the recent main crashes of the last 20 years on the swiss index, we can see the CH20 following the global trend and recovering the losses in the following years.

***

Disclaimer:

The content of any publication on this website is for informational purposes only.